Ratio Analysis

Valuations

Charting Technique

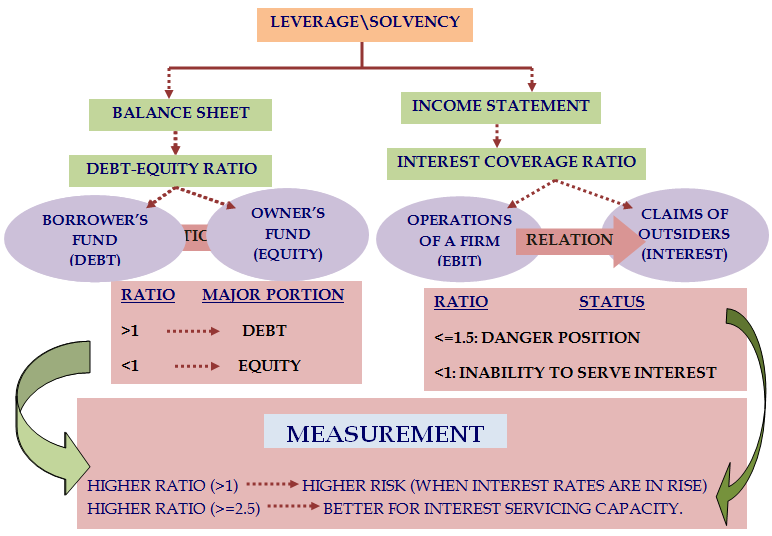

- Solvency denotes about the survivial of an entity over a long period

- Solvency depends upon ability to pay INTEREST and repay PRINCIPLE at the time of Debt maturity

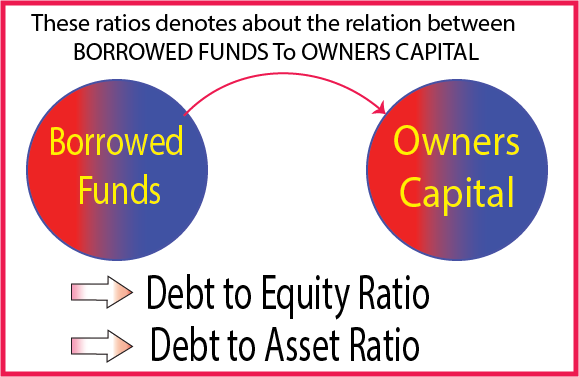

- It denotes about the relationship between BORROWERS FUNDS To OWNER'S CAPITAL

- In Other words, it denotes what proportion of Equity & debt that the company utilized to Finance the Business

- Solvency states about the dependency of a firm on BORROWED FUNDS

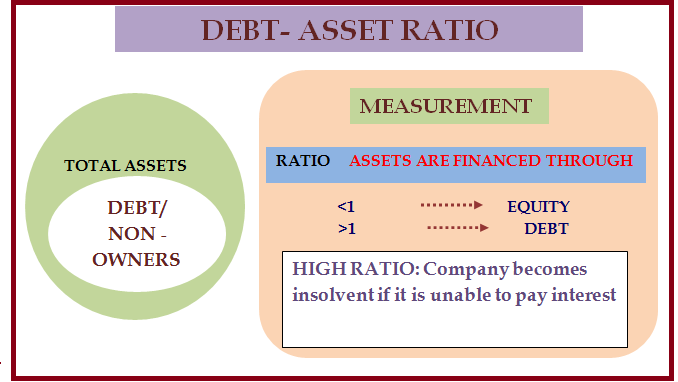

- A ratio greater than 1: Denotes assets are mainly financed with Debt

- A ratio less than 1: Denotes assets are mainly financed with Equity

- It is more risky if the ratio is HIGH., as company has to pay high interest rates., when rates are in boom

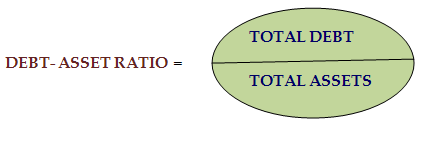

- Denotes about the proportion of ASSETS., which are financed through DEBT

- If the ratio is < 1, most of the company's assets are financed through equity

- If the ratio is > 1, most of the company's assets are financed through debt

- Interest Coverage Ratio

- Debt Service Coverage Ratio

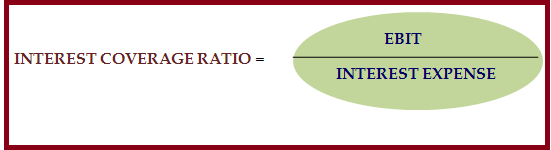

- It denots how many times that the company having the ability to pay INTEREST

- This ratio is yard stick to measure the potentiality of the company withrespect to Interest payment

- (OR) The interest coverage ratio measures the ability of a firm to meet its interest payments

- Interest Coverage Ratio is a Ratio between "Earnings before Interest and Tax", and Interest on "Long Term Loans\Debt".

Result:

- Lower Ratio denotes, more the company is burdened by debt expense

- Higher represents to: more secure for lender in respect of periodical interest payments

- An interest coverage ratio below 1.0 indicates the company unable to generate income to pay its interest

- coverage ratio with 6 - 7 times is apt

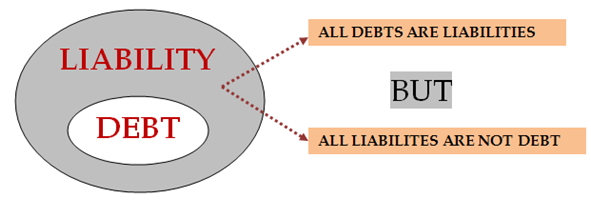

- Debt is a part of Liability.

Capital Structure\Solvency Ratio

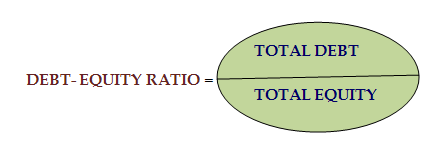

Debt To Equity Ratio

Formula:

Interest Coverage Ratio:

Debt Asset Ratio

Note:

Companies with high debt/asset ratio becomes insolvent if creditors demanded to pay debt

Coverage Ratios

Interest Coverage Ratio

FAQ: WHAT IS THE DIFFERENCE BETWEEN DEBT AND LIABILITY?