Ratio Analysis

Valuations

Charting Technique

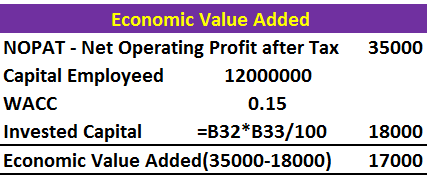

- EVA - Economic Value Added

- Through this metic we can evaluate the performance of an entity

- EVA is the process of Earnings estimation whether it has the status of Excess/Short fall to Minimum rate of return

- Concept of EVA is: if earnings of company is greater than expected, then value has been added.

- Market value of the company depends on Future EVA Values

- Market value of the company depends on Future EVA Values

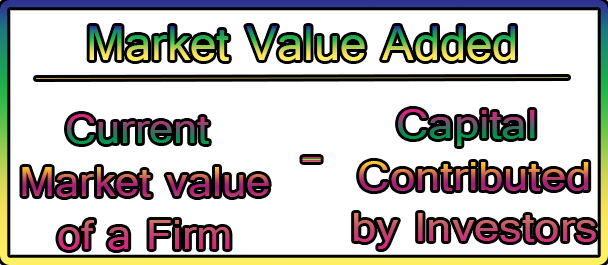

- Market value added (MVA) represents to:

- If MVA > 1 then MVA has Added value

- Market value = Total Capital Employeed +/- Net present value of all future Economic Value Added.

- By Increasing the return

- Reduce Cost of capital

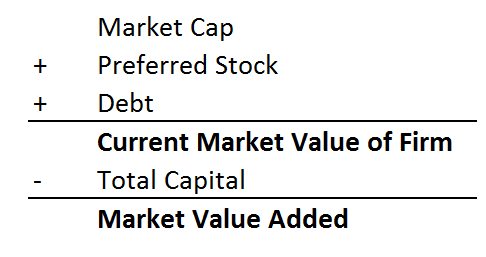

EVA Analysis - Economic Value Added

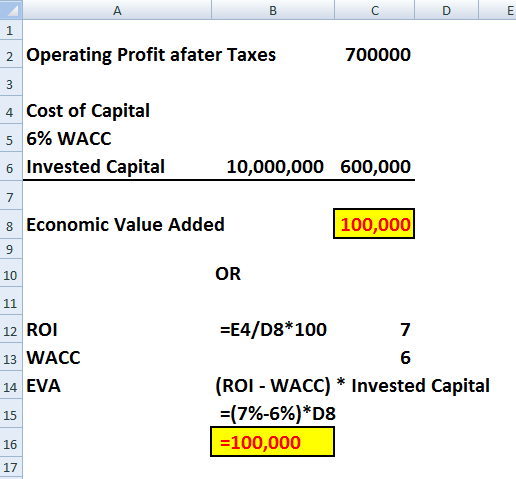

EVA Valuation Formula:

Example:

EVA Market Value

Market Value = Book value of equity + present value of future EVA

Differnce between EVA and MVA

The difference between the market value of equity and net debt and the book value of capital employed

MVA Calculation Procedure:

How to increase EVA?