Ratio Analysis

Valuations

Charting Technique

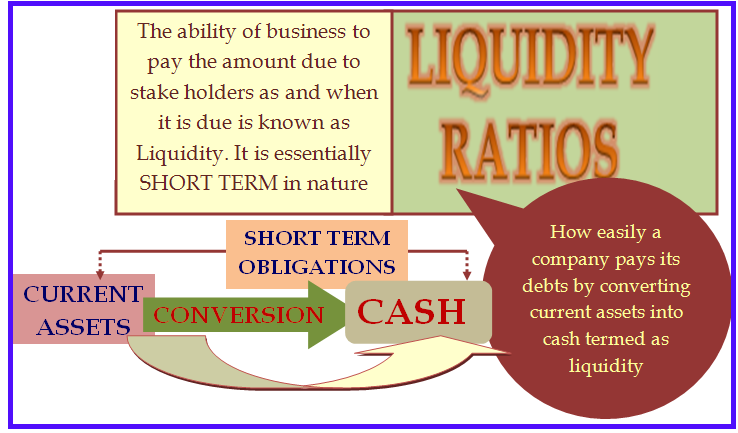

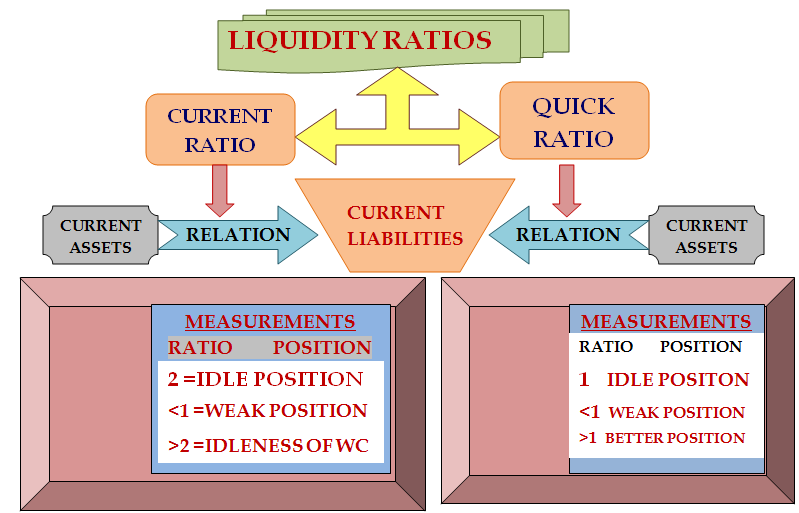

- Denotes about the company's ability to pay SHORT TERM DEBT/Obligations

- This ratio is also known as working capital ratio.

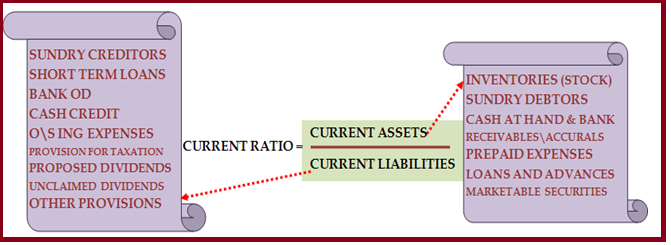

- Current ratios denotes the relation between current assets and current liabilities of an entity

- Current liabilities are immediate financial obligations of the company whereas Current assets are the sources to repay current liabilities

- Current ratios indicate the relation between current assets TO current liabilities

- Current liabilities represent the immediate financial obligations of the company

- This ratio is yardstick to measures how far company meet financial obligation as and when they arise

- Higher the Current Ratio, Higher the short term liquidity.

- This ratio denotes about the capacity of the company to meet financial obligation

- Ideal Ratio is 1.5 to 2

- This ratio is also termed as WORKING CAPITAL RATIO

- Too High: Current Assets are too high than liabilities., it denotes too much of funds invested on CURRENT ASSETS

- Too LOW: Current Liabilites are too high than Assets., Unable to maintain the risk

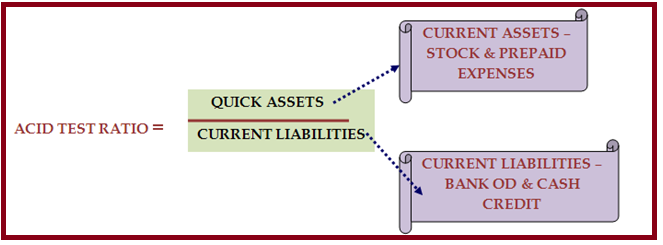

- Quick assets = current assets - stock and prepaid expenses

- Stock is excluded because it is not immediately realizable in cash

- Prepaid expenses are excluded because they cannot be realized in cash

- Stock not able to convert into cash easiliy in case of CURRENT ASSET., hence it is not more appropriate to measure based on current ratio

- Quick ratio is a modified version to current ratio which excludes the cash, useful for measure short term obligations

- Minimum Quick ratio is 1:1

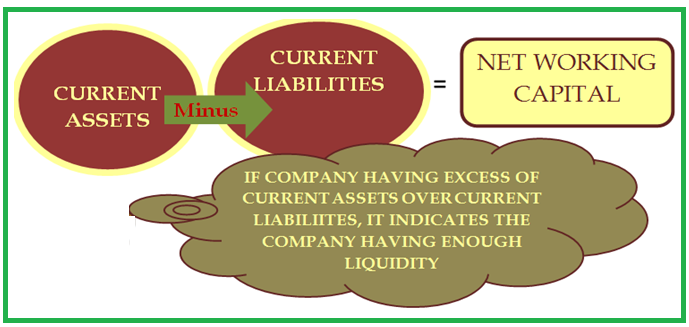

- If the company having enough Net Working Capital it denotes that company having enough Liquidity

- Net Working Capital = Current Assets - Current Liabilities

Liquidity Ratios

Conclusion:

Higher the Ratio is better

Higher the Ratio is better

Formula:

Current Ratio

AcidTest Ratio

Formula:

Limitations:

What is the relation between NET WORKING CAPITAL to LIQUIDITY

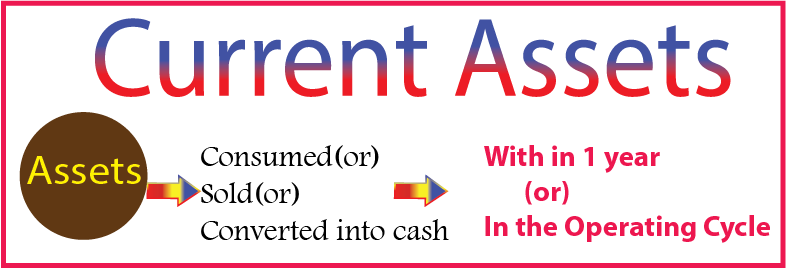

What is CURRENT ASSETS

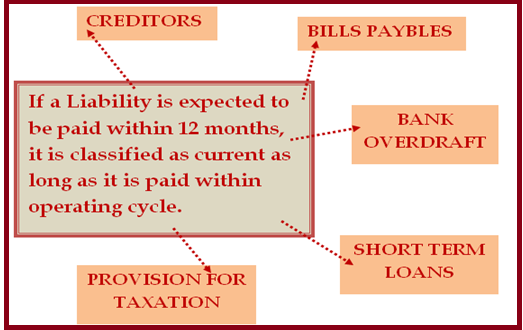

What is CURRENT LIABILITIES?