Ratio Analysis

Valuations

Charting Technique

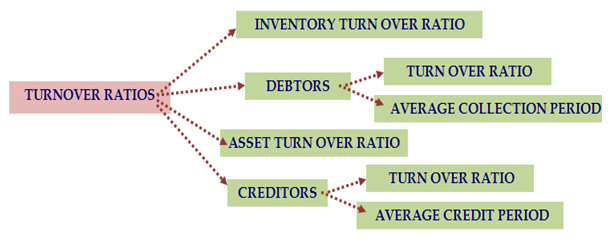

- Also termed as Effeciency Ratios

- Asset management ratios are also called Turnover ratios\efficiency ratios\Activity Ratios

- These ratios measures the relationship between Various Assets to Sales

- It denotes in terms of TIMES

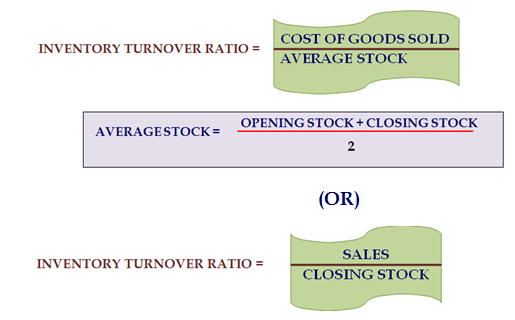

- It indicates the number of times the inventory is rotated during the particular period

- Inventory turnover ratio measures the velocity of conversion of stock into sales.

- (Average Inventory/Sales) x 365 for days

- (Average Inventory/Sales) x 52 for weeks

- (Average Inventory/Sales) x 12 for months

- High inventory turnover denotes efficient management of inventory., i.e more frequently the stocks are sold, and the lesser amount of money is required to finance the inventory.

- Low inventory turnover ratio denotes inefficient management of inventory

- A low inventory turnover implies over-investment in inventories, dull movement in goods

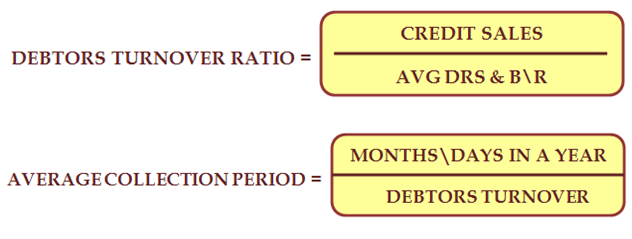

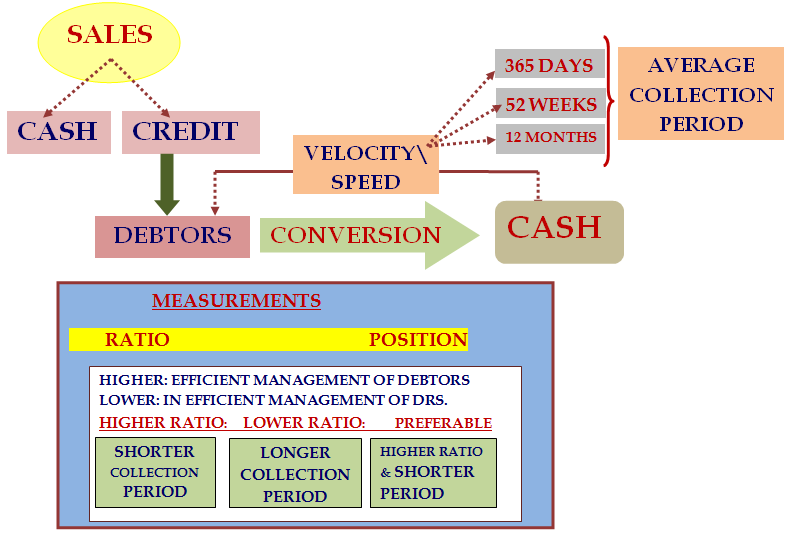

- Sales can be either CASH\CREDIT. This ratio applicable for credit sales

- Debtors Turnover Ratio denotes the speed at which a company collects its debts.

- It establishes relationship between Credit sales & Debtors.

- High Turnover Ratio and shorter collection period is indicative prompt payment by Debtor

- Higher Ratio denots debts are collected quickly

- (or) high ratio indicates the shorter collection period which implies prompt payment by debtors.

- Low Turnover Ratio and Longer collection period indicates delayed payments of Debtors

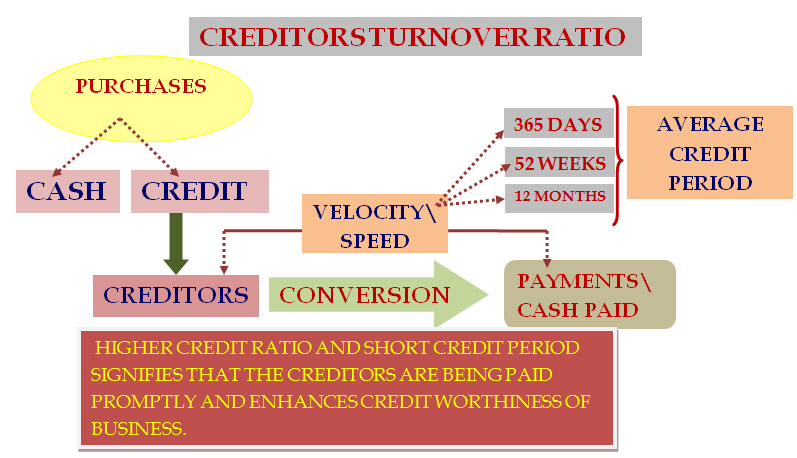

- It signifies the credit period assigned by creditors to the firm to pay

- It denotes the relationship between credit purchases and average creditors.

- Accounts payable include both sundry creditors and bills payable.

- Denotes payments are made to suppliers by the company

- Average payment period ratio: Denotes the number of days by the firm to pay its creditors

- A high creditors turnover ratio or a lower credit period ratio signifies that the creditors are being paid promptly

- which enhances the credit worthiness of the company

Turnover Ratios

Inventory/Stock Turnover Ratios - - Times

Results:

Debtors Turnover Ratio - - Times

Creditors Turnover Ratio - - Times

(i)Creditors Turnover Ratio (ii)Average Payment Period