Ratio Analysis

Valuations

Charting Technique

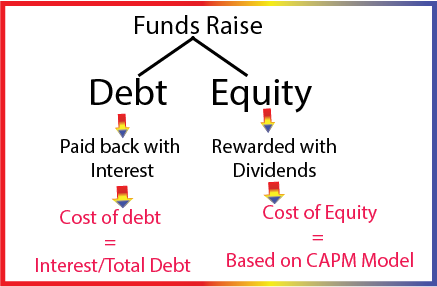

Cost of Equity

- It is a return to a company for its capital investments

- Of the available sources (i)Debt (ii)Equity., Later provides higher rate of return than DEBT

- Dividend Growth Model

- Capital Asset Pricing Model

- Company must pay dividends

- It is not necessary that company requires to pay dividends

- Beta: Risk on stock price

We can calcuate cost of equity in two ways:

Dividend Growth Model:

Capital Asset Pricing Model:

Cost of Equity = Risk-Free Rate of Return + Beta * (Market Rate of Return - Risk-Free Rate of Return)