Ratio Analysis

Valuations

Charting Technique

- Cash plays a very important role in the economic life of a business.

- Primay Object of Cash Flow statement is to provide information regarding a company’s cash receipts and cash payments.

- As a firm it need to maintain an adequate cash in order to make payments to its suppliers/ to incur day-to-day expenses and to pay salaries, wages, interest and dividends etc

- The cash flow statement became mandatory for publicly traded companies in 1987

- The Accounting period for the Cash Flow Statement is the same for which Profit and Loss Account and Balance Sheet are prepared.

- Only listed companies are required to prepare and present Cash flow statement

- Cash in hand

- Demand deposits with banks, and

- Cash equivalents

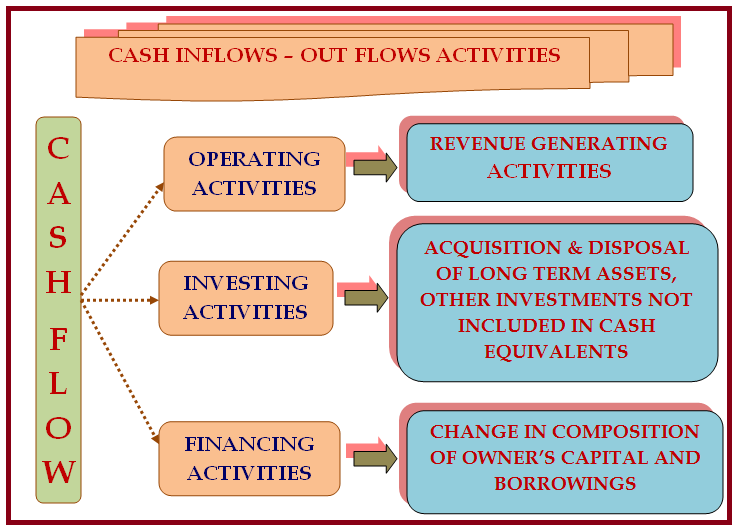

- Operating Activities

- Investing Activities

- Financing Activities.

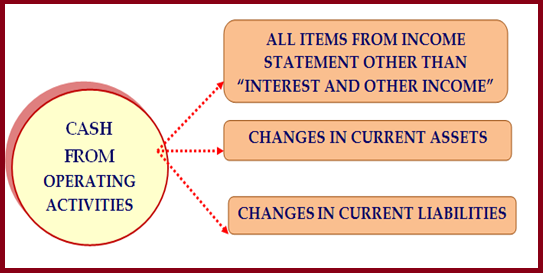

- Is the principal revenue generating activities of the enterprise and other than activities that are not investing or financing activities

- Operating activities are those which produce either revenue or are the direct cost of producing a product or service

- Include the acquisition and disposal of long-term Assets and other investments not included in cash equivalents

- Associated with purchases and sales of non-current assets (Example: building and equipment purchases or sales of investments or subsidiaries.)

- It denotes about Transactions of Investing activities which include buying and selling noncurrent assets utlized to generate revenues

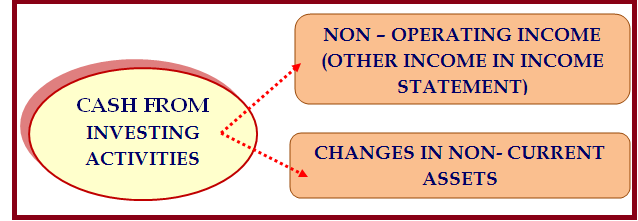

- Any Item which is classified as LONG TERM ASSET in Balance Sheet, comes under INVESTMENT ACTIVITY

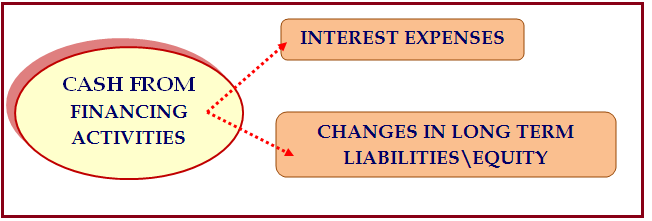

- Transactions that result in change in the owner’s capital (including Preference share capital /Preferred Equity in company) and borrowings of the enterprise

- It denotes borrowing and repaying money, issuing stock (equity) and paying Dividends.

- Any item that represents to either a long-term liability or equity in Balance Sheet comes under financing activity.

Cash flow statement

WHAT IS CASH REPRESENTS IN CASH FLOW STATEMENT?

As per AS-3 (revised) issued by the Accounting Standards Board:

Cash Fund includes:

The statement of cash flow shows three main categories of cash inflows and cash outflows

OPERATING ACTIVITIES (OPERATIONS & WORKING CAPITAL:

INVESTING ACTIVITIES (NON-CURRENT ASSETS & INVESTMENTS):

Ex:The purchase\Sale of property, plant, equipment,Machinery and other productive assets is classified as an investing activity

FINANCING ACTIVITIES (LONG TERM DEBTS, EQUITY & DIVIDENDS):